How To Secure A Rock-Bottom Interest Rates On Your New Mortgage Loan Or Refi

In life, you will make many decisions. You will select your career, your marriage partner, your preferred state to live, your preferred car to drive, and your home.

The latter decision is very important because of the initial costs involved and how it can influence your lifestyle.

In the United States, house prices have been on an upward trajectory with the median house price in the country being more than $200,000. This amount is unaffordable to many people.

This is where mortgages come in. Mortgages help people acquire houses and pay in small monthly installments. Today, more than 80% of all Americans have debt, and from these, 44% of them have mortgage debt.

Below, I highlight some of the best online mortgage lenders you can try.

Rocket Mortgage

Rocket Mortgage is an online-only mortgage provider from Quicken Loans. It is one of the biggest providers of mortgage providers in the country. In 2016, the company funded more than $7 billion in closed loans. If it was an independent company, Rocket Mortgage would rank among the top 30 mortgage providers in the country.

Using Rocket Mortgage, customers fill their data on its web or mobile platforms and then receive their approval within minutes. During the application, the customer does not use any paperwork whatsoever because the process is automated.

To apply for a Rocket Mortgage, you first need to create an account and then answer a few questions about yourself. Then, you should connect your bank accounts to the account you just created and then fill a few questions that are required by law. After answering all questions, Rocket Mortgage will give you several options for paying for the house so that you can select the one appropriate for you.

This process can take less than 20 minutes to complete.

Rocket Mortgage offers fixed-rate loans of between 8 to 30 years with ARMs of 5/1, 7/1, or 10/1. It accepts anyone with a minimum credit score of 620.

SoFi Mortgage

SoFi (Social Finance) is an online-only company that gives people a platform to borrow, invest, and insure.

The company’s online mortgage services allow people to borrow money by paying 10% of the home value and then paying the rest in installments. In application, the company analyzes the customer’s FICO scores and consider other factors like professional history, career prospects, income, and other factors like bill payments.

To apply for a mortgage with SoFi, you first enter your details on this page. Then, you should enter basic information like your state, whether you are buying or refinancing the house, your marital status, and whether you have another home. Such simple details.

Then, on the next page, you will be asked to enter your purchase price, down payment amount, and the amount you are borrowing. Finally, the platform will show you the rate quotes which you will select.

After this, you will wait for approximately 28 days before you know your fate.

The benefits of SoFi are that it considers non-traditional credit history, an average closing period of 28 days, it has no origination and application fee, and it offers flexible down payments that range between 10% and 50%.

The only challenge with SoFi is that it requires a minimum loan amount of $100,000.

Lenda

Lenda is a relatively new company in this space but one of my favorites. The company offers online mortgages and refinancing services.

To apply for a mortgage with Lenda, all you need to do is to answer several questions on this page for prequalification.

Then, on the next page, you will be given several options which you are supposed to select the one that matches your liking. Then, the Lenda suggestion engine will use its algorithms to see whether there are inputs you can enter to reduce your payments. Then, you enter several details, check your credit score, and then attach documents.

The entire process takes less than ten minutes, and the loan is processed within 36 days.

The pros of Lenda is that: there are no paperwork, fast processing period, the Lenda suggestion engine can save you money, cheap, and transparent.

The only problem with using the service is that it currently operates in five states (California, Colorado, Oregon, Texas, and Washington).

PennyMac

PennyMac is a public company started in 2008. The company offers customers mortgage and refinancing services online.

To get a mortgage with the firm, all you need to do is visit the website and answer a few questions about yourself. Then, PennyMac will give you a quotation page where you can select your preferred option or adjust your inputs to get a better deal.

Among the benefits of using PennyMac is that it offers government loans like FHA, USDA, and VA loans. Also, it has 15 locations where customers can be assisted. Also, it is offered across all states, and it has no minimum income requirement.

The only problem with PennyMac is that it charges origination fees and its loan calculator is usually not accurate because of the many assumptions it makes.

Better

Better was started in 2014 after its founder went through hell finding a good mortgage. Better aims to be the best mortgage and refinancing provider in the country by making the borrowing process transparent and fast.

To apply for a mortgage with Better, you are required to follow a few steps. First, you need to get pre-approved by answering a few questions, a process that takes about three minutes. After answering the questions, the verification process will take 24 hours or less. Then, you will be presented with a few flexible options for you to select from. Finally, you will be required to complete the application process.

The key pros of using better are faster loan closing of 10 days, getting an estimate within 3 minutes, transparent, support staff are not paid using commissions, a low deposit of 3% of the house, and an offer within 24 hours.

The only problem with Better is that it offers its services to several states including Arizona, Georgia, California, Illinois, Washington, Pennsylvania, Oregon, New Jersey, North Carolina, District of Columbia, Connecticut, and Colorado.

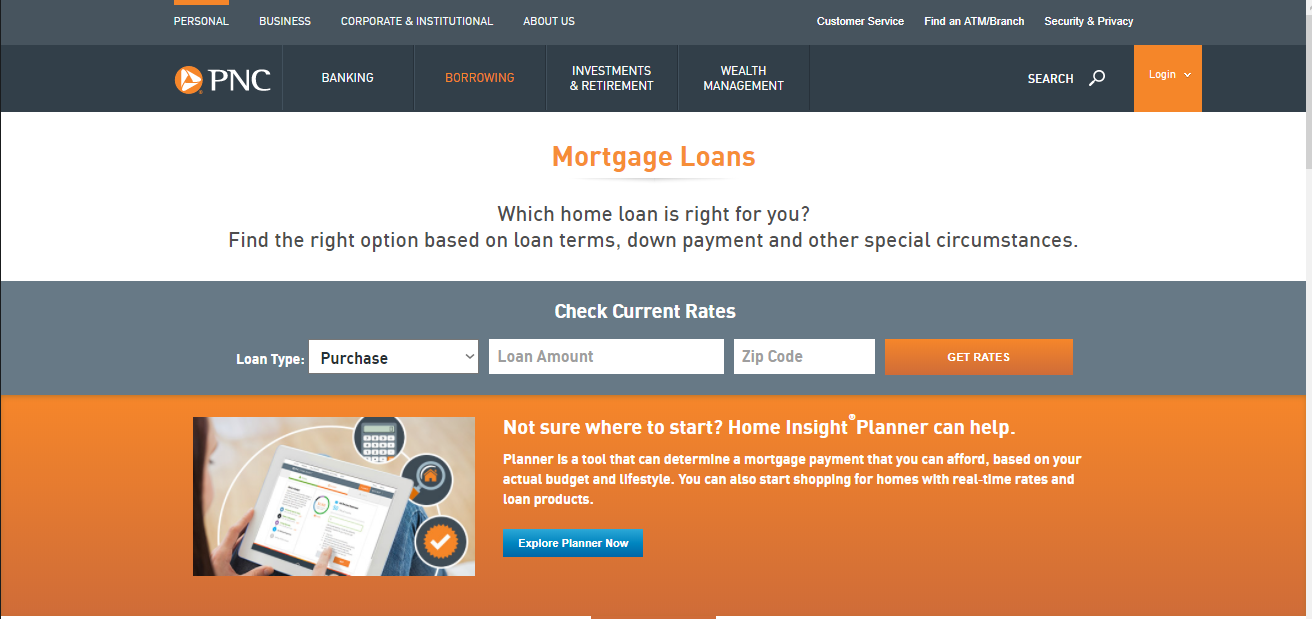

PNC Financial

PNC Mortgages is a product of PNC Financial Group, a Pittsburg based company with more than $366 billion in assets. The company operates more than 2,500 branches in the country where customers can get mortgages.

However, customers can also use its website to get any of its 5 types of mortgages which include: jumbo, fixed rate, adjustable rate mortgage, FHA, and VA loans.

To get a loan, all you need to do is visit this page and select the type of loan you want. Then, after filing the information on this page, you should wait for the bank to contact you within 1 to 2 days with more information.

The pros of using this company is that information on rates is readily available and that it has a large network of branches where you can get help from.

The problems with it are that the application process is not entirely online.

Final Thoughts

Applying for a mortgage can be hectic. From the paperwork to the determined sales executive looking to make a sale, to the cost, and to the lines in the bank. No one loves that.

Applying for a mortgage or refinancing online is an essential way of saving you money, time, and energy. That is why I recommend any of the companies I mentioned.

But, before you apply, ensure that you understand the type of mortgage you are applying to. Is it a fixed rate or variable? Ask those questions or do the research yourself. Also, make sure you read the terms and conditions page to get more details about the loan.